The four major currency pairs account for about two-thirds of all the daily turnover in the foreign exchange market and are the most-watched barometers. The majors are EURUSD, USDJPY, GBPUSD and USDCHF. When we say the USD is strong or weak, we mean against these four currencies. If GBPUSD is strong and the other three are unchanged, then we can say it is GBP which is strong. All these currencies have individual drivers or . It can be that the news (a fundamental) is good for the US and the USD moves up against the rest. In this case, it is the USD that is strong.

Fundamentals can be news, economic data, interest rate changes, central bank actions and many other factors. But it is never correct to say that a particular fact will have a predictable and calculatable effect on the price. It depends on how the market perceives the news and that will determine how price reacts to it. However, we can say that well-managed currencies with strong fundamentals will be strong and desirable. A poorly managed economy with bad fundamentals will be punished against other currencies.

Remember, there are no hard and fast rules concerning market reaction to the news and economic data. The market may receive some good news, but the currency may fall when it is announced. This can because it was expected, and the market was positioned for it. The news was forecast to be good, so people had already bought in advance. Therefore, now the good news has been released there is no more good news due and there are profits to be taken, so it may fall. The news may be good but not as good as expected and therefore interpreted as disappointing good news. The market might then fall. Traders say, ‘Buy the rumour and sell the fact’.

Do not forget that most news is expected. Economic releases are made on certain dates at certain times; elections occur and are not a surprise. The market expects almost all news which it has already priced in. Therefore, only when the actual news deviates from the expected news does the market make shocking price movements.

There are other types of news which are not predictable and appear randomly: Presidential tweets, assassinations, adverse weather, terrorism, fraud, scandals. This type of news cannot be predicted and often result in violent short-term market moves. These are genuine market shocks (out of the blue) as opposed to expected market shocks (when a surprising piece of economic data was released on its due date). There is no time to prepare for these shocks, which can even be events.

Exchange Rates

On 1st January 1999, the Deutschmark, Italian lira, French franc, and nine other European currencies disappeared, and the euro was born. In adopting a single currency, the European Union (EU) members agreed to abide by fiscal policy constraints, which limited the ratio of national budget deficits to Gross Domestic Product (GDP). The nations also delegated monetary responsibility, setting interest rates to the newly founded European Central Bank (ECB). As an economic bloc, the eurozone roughly equals the US in both population and total GDP. This is the largest and most popular currency pair traded – EURUSD. The euro's liquidity is unmatched in other currency pairs and it, therefore, has the narrowest of all spread between the Bid and the Ask prices. According to the latest BIS survey, EURUSD accounts for 28% of daily turnover. The trading is more than 150% greater than the next most active pair, USDJPY.

The euro is the primary currency to respond to US news. If weak US economic data is reported, traders typically sell the dollar, but against what? Euro is the first choice because it is the next biggest currency and most liquid, allowing for easy entry and exit. Of course, the opposite is true if the news from the US is good. The EURUSD also reacts to European news. However, the most significant driver is US news, particularly in the European afternoon. In the European morning, the US dollar news and fundamentals are asleep: no economic news or Presidential Tweeting is going on. In the European afternoon session, both the euro and the US dollar can have news flows. There can be strong trending moves at that time of day. In the US afternoon, European news flow quiets, and from then on and through the night, the dollar dominates.

US Dollar Economic Data and Influences

The dollar rate reflects the dollar’s fundamentals and economic data and the fundamentals and data of the currency it is paired with. It is the pivot in most currency pair trades. Usually, when you are trading currencies, you are taking two positions: one in the dollar and the opposite in the paired currency.

The dollar is a big picture currency. Forex traders focus on interest rate differentials between currencies and monetary policy developments, economic growth and inflation data, political elections and developments in the US and the rest of the world, geopolitical risks, trade conflicts, and terrorist attacks, major developments and movements in other financial markets such as the stock market and oil. Sometimes the market wants to shy away from risk, and sometimes wants to embrace it. When the market feels confident, it will assume the risk. When the market is fearful, it will shy away from it and move towards safety. One of the best and most efficient instruments to achieve this is to sell or buy the mighty US dollar. The US dollar is the benchmark instrument which represents the big picture of global currency sentiment.

Sadly, there is no set way to digest the constant flow of data and news and get a clear answer for a currency's value. It is simply not a formula – much to the chagrin of economists and fundamental analysis. Even if it were possible, the different market participants are pursuing their agenda as they trade the markets. Sometimes they may not even be profit maximising – hedgers or wanting to change currencies for commercial reasons. Add to that, and we have market sentiment, future expectations, fear and greed. You have the marketplace interpreting the same data and reaching different conclusions or reaching the same conclusions but at different times. What makes a currency is as much psychological as fact-based.

Euro Economic Data and Influences

European data has only a small impact on the EURUSD rate. Individual European countries’ financial conditions are not overwhelmingly important to Europe as a whole. The two most significant members’, Germany and France’s financial data, can register with the markets as they have so much weight on the whole union's industrial performance.

There are two exceptional conditions to be aware of: stresses on Euro cohesion and post-Brexit stresses. When either The Euro or post-Brexit squabbles dominate the market, then economic or political news from the UK or the weaker Euro members can take on greater importance than usual.

Monetary Policy and Interest Rates

If one currency pays higher interest than another, then it should be more desirable and stronger. Indeed, with forex positions (remember all positions are two trades: long one currency vs short another), you can sell the lower interest yielding currency and buy the higher interest yielding currency and pocket the difference. Therefore, you have borrowed cheap and lent more expensively receiving the interest rate differential. This is the basis of the . So, interest rates and interest rate policy are vital in deciding which currency is desirable or not.

Rate relationships

Interest rate relationships set the background for any currency pair. Currencies may move up or down in the short run, but their interest rate relationship is their dominant driver in the longer run. Interest rates are significant to currencies because they influence and serve as benchmarks for what investors expect to earn in a country. This applies most directly to fixed income investing (bonds), which comprise the bulk of all investments and influence equity and other investment flows. All things being equal if you could invest in a government-backed (sovereign) bond that yields 6% over one that yields 2%, which would you choose? The one with the higher yield is the most attractive currency. Currencies with higher yields tend to go up, and currency with lower yields tend to weaken.

What moves rates?

Central banks set interest rates but can only determine them to a certain extent. Not all central banks are independent and may be strongly influenced by politicians; they can also be forced to act because of market pressure. If rates are being pushed down in the open market, a central bank will be forced to follow and set its official rate lower.

Also important is the market's expectation for the direction of a currency’s interest rate. A central bank may be tightening money or be . Or it may be loosening money or be . Higher interest rates make borrowing money more expensive, which is tightening. In contrast, lower interest rates make it easier and cheaper to borrow, which is loosening. Central banks themselves or members of the rate-setting committee may be referred to as Hawks or Doves. How quickly a central bank is affecting its rate changes and over what time horizon is also important to the market.

The most pronounced effect of interest rates on currencies comes from changes in economic cycles. When interest rates have been moving lower in a country for some time, there comes a point when rate cuts come to an end. The interest rate cycle is coming to an end and will reverse. Markets are expecting the next change in interest rates to be an increase. Although the market may be uncertain about the exact timing of the first interest rate rise, the markets are always looking ahead in time. They will anticipate and speculate on that timing of the change in the interest the rate direction. This shift in expectations is a signal to traders who have been selling the currency with falling interest rates to begin to reduce their positions. As the picture of a bottoming out of interest rates becomes more apparent, speculation will increase that the next move will be up. More positions are taken off reflecting the lower interest rate view, and new positions are opened speculating on an increase in interest rates. The currency's impact can be substantial over a long period and frequently initiates a change in its long-term trend. The interest rate cycle will last many years and set the tone for a currency for many years. The inflexion points and interest rates bottom out or top out can be very tricky and volatile times. As you can imagine, some of the largest currency swings occur when two countries' interest rate cycles move in the opposite direction. Remember, if a central bank of one country raises its interest rate by 25 basis points (bps) and another lowers its interest rate by 10 bps, that is a gross 35 basis points difference and may cause a big move thing the currency pair.

Interest rates: Real and Nominal

The base interest rate you see, such as the yield on a bond or the central banks, is called the . But markets focus on (inflation-adjusted rates, which is the nominal interest rate minus the rate of inflation). If the currency or bond is yielding, say 8%, and the inflation rate (usually consumer price index) is 5%, then the current currency’s value is depreciating in real terms. The real interest rate is the nominal rate minus the rate of inflation, which is 3%. So, in this case, the 5% yield is only 3% after inflation.

Two extremes of the implications of the difference between Real and Nominal interest rates are Japan on the one side and some emerging markets on the other. We have seen interest rates at very low levels, eventually at zero, and facing deflation, real Japanese yields are significantly higher than nominal zero rates on offer. Subtracting a negative number is the same as adding a positive number, so the JPY experienced overall appreciation despite meagre nominal rates and abysmal economic conditions.

In contrast to the low interest rate and strong currency scenario, we have seen high interest rates but near hyperinflation and a weak currency in some emerging market economies. Even though nominal interest rates of 20% or more are typical, if the annual inflation rate is 25%, the real yield is -5%. Hyperinflation and negative real yields lead to capital flight. Everyone wants to get their money out of the country and into another with a stronger currency. The result is an extreme domestic currency weakness, even though nominal interest rates may be too high. This is called a flight to quality.

Central Bank Monetary Policy

Central banks have policies which are defined in law. This is called their mandate. In free economies, they have two objectives defined under their mandate:

-

Promoting price stability. For many, this is restraining inflation.

-

Promoting continued economic growth, sometimes explicitly including increasing and maximising employment rates.

Different countries put different emphasis on these two objectives. Even amongst free economies, there are different levels of independence for national central banks. Some central banks are quite close to the political structure; others are fiercely independent. Low inflation is particularly important in some countries because they have experienced high or hyperinflation within their recent history. For others, growth is their main objective.

The European Central Bank (ECB) has only one mandate objective: to ensure price stability. Other objectives, such as growth and employment, are secondary. The Swiss National Bank (SNB) has the mandate to ensure a stable currency. The SNB, therefore, is active in the forex market. Most countries have delegated that responsibility to their national finance ministry or Treasury Department.

Easy and Tight Money

There are two stances for central bankers: they are either expansionary or restrictive regarding monetary policy. The movement between the two is called the bias of the central bank. An expansionary policy aims to expand or stimulate economic growth (in other words stimulate the economy), or a restrictive bias aims to slow economic growth, almost always to fight off the threat of inflation. At the extremes are the easiest of all postures for a central bank: Quantitative Easing (QE); or tightest of all: managed Austerity.

Expanding, Restricting, Quantitative Easing and Tapering Monetary Policy

Expanding Monetary Policy

Expansionary monetary policy is typically achieved by lowering interest rates. This reduces the cost of borrowing in the hope of spurring investment, consumer spending and growth. Cutting interest rates is also known as easing. You may also hear central banks are being accommodative or stimulative. Central banks can also increase the money supply and the quantity of money circulating in the economy, reducing borrowing costs. A reduction in banks' reserve requirement frees up capital to lend money, adding to the money supply and reducing borrowing costs.

We need an expansionary monetary policy when economic growth is low, stagnant or contracting and unemployment is rising. A more specific monetary policy can also be introduced in response to major shocks to the financial system, like following the 9/11 terror attacks in the US and the 2008 global financial crisis.

Restrictive Monetary Policy

Restrictive monetary policy, also known as tighter monetary policy, is achieved by raising interest rates. Higher interest rates increase the cost of borrowing and work to reduce spending and investment to slow economic growth.

Central banks typically employ a tighter monetary policy when an economy is believed to be expanding too quickly. The central bank fear is that the heightened demand, coupled with the low cost of borrowing, may lead to inflation and beyond acceptable levels. With too much money chasing the same or too few goods, prices begin to rise, and inflation rears its ugly head. Rapid wage gains, for example, may lead to increased personal consumption driving up the costs of all manner of goods and services.

Quantitative Easing

Quantitative easing (QE) is a form of relatively new and unconventional monetary policy. The central bank purchases longer-term securities from the open market to increase the money supply and encourage lending and investment. Buying these securities adds new money to the economy, and promotes lower interest rates by bidding up . It also expands the central bank's balance sheet.

When short-term interest rates are either at or approaching zero, a central bank's normal open market operations, which target interest rates, are no longer sufficient. Instead, a central bank can target specified amounts of assets to purchase. Quantitative easing increases the money supply by purchasing assets with newly created bank reserves (printing money) to provide more liquidity. The danger of this is to threaten inflation which might get out of control.

The first country to use QE was Japan. Following the Asian financial crisis of 1997, Japan fell into a deep recession. In 2000, Japan's central bank, the Bank of Japan (BoJ), began an aggressive QE programme to curb deflation and to attempt to stimulate the economy. The BoJ started by buying government bonds and then moved on to buying private debt and shares. However, the campaign failed to meet its goals. Between 1995 and 2007, Japanese GDP fell from USD 5.45 trillion to USD 4.52 trillion in nominal terms, despite the BoJ’s determined efforts.

As defined as a percentage of a country's GDP, the biggest QE effort was the Swiss National Bank’s (SNB) response to the 2008 financial crisis. The SNB eventually owned assets that were nearly equal to the annual economic output of Switzerland. Although economic growth has been positive in Switzerland, it is unclear how much this can be attributed to the enormous QE programme. The Swiss kept interest rates below zero for years without much noticeable effect.

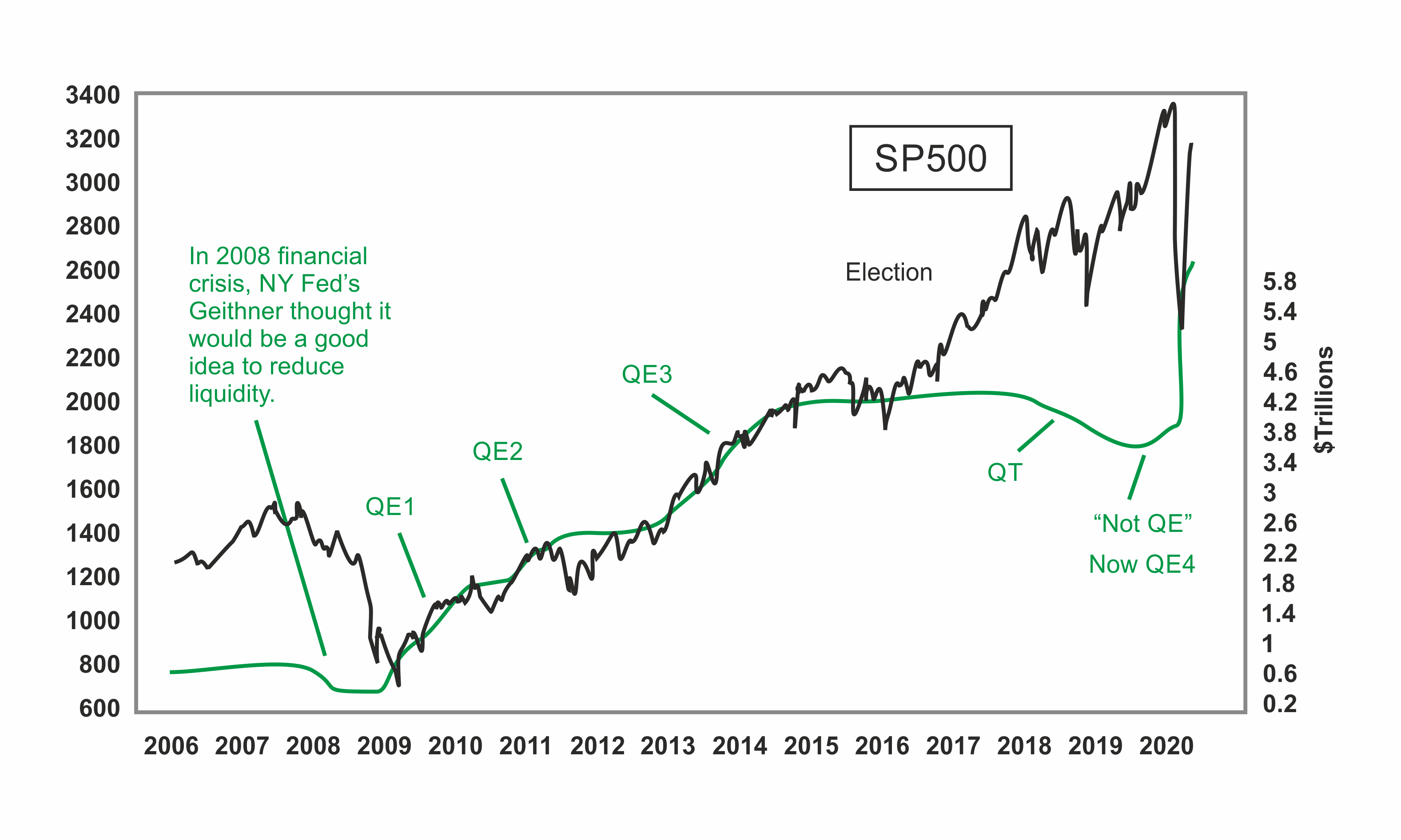

Figure 16QE and Tapering

Figure 16QE and Tapering

In the UK in August 2016, the Bank of England (BoE) announced it would launch an additional QE programme to help address the potential effects of Brexit. From August 2016 through to June 2018, the UK suffered a government policy combined with government deficit spending. It is therefore not clear how much benefit QE had for the UK economy.

On 12th March 2020, the US Federal Reserve announced its plan to implement up to USD 1.5 trillion of asset purchases as an emergency method measure to provide liquidity for the US financial system. This was called QE 4 since it was the fourth round of quantitative easing. The decision was made easier for the US central bank because of the massive economic and market turmoil brought on by the rapid spread of COVID-19 and ensuing economic shutdown.

Tapering

Tapering is the ‘weaning off’ of QE. QE makes money nearly free to large borrowers. This should stimulate the economy. But to print this money, central banks must borrow. This is a future burden for the economy and the next generation.

The market is greedy for cheap money. A lot of it flows directly into the stock market. The threat of is most directly felt in the stock market. This is bad for sitting politicians as it makes people unhappy, and they may blame politicians. The politicians may pay the price at the polls. So far, there have been no successful tapering operations by central banks. Although the UK government can claim some success during the Cameron years when government spending was throttled, easing government borrowing pressure.

Global Pandemic

The COVID-19 global pandemic has affected all world economies, and developed countries have increased spending enormously to support employers, the unemployed and industries devastated by the economic slowdown. Recession and inflation are now real threats.

Central bank intervention into the forex market

Governments and central banks are generally reluctant to directly influence the currency markets even though they might wish to bolster or suppress their currency if it becomes too weak or too strong. They know they cannot make a currency go anywhere because even the largest governments and central banks are too small. Forex markets are much bigger than any one nation’s reserve; they operate outside their national jurisdiction; they have no control over the market structure. Together, countries rarely manage to agree what is in all their best interest and achieve coordinated intervention. One currency strengthening happens at the expense of another weakening. It is difficult and rare for governments to agree and to act together. And, as a principle, they do not want to mess with the free market. Tampering with international capital flows is a recipe for economic disaster.

If governments had their way, they would prefer to see fixed exchange rates replacing floating rates. Some openly call for a return to the gold standard. Governments could then negotiate these fixed rates with each other but not with the open market. But that is not realistic.

Influential national governments and central banks

The United States Treasury

The Department of the Treasury has a legal mandate to manage the USD, from printing dollar bills and minting coins to ensuring the USD's soundness in the international markets. The Secretary of the Treasury is the primary spokesman for the USD. The Deputy Treasury Secretary for international affairs is a hands-on treasury official responsible for day-to-day currency matters. When the Treasury Secretary speaks on the dollar's value or any other currency, the forex markets listen.

The Euro Zone

The European Central Bank (ECB) is responsible for monetary policy and currency matters under the euro (EUR) agreement in 1999. The ECB central council is the primary decision-making body; it comprises the Executive Board's six members, plus the governors of the national central banks of the 19 eurozone countries. The ECB president is the group's chief policymaker and spokesman. When the ECB needs to intervene in the market, it can do so by itself, along with central banks of the member states on its behalf.

An individual finance minister has little market influence on their own. They meet regularly as a group and frequently weigh in on forex market developments. The market listens when the two largest economies – Germany and France – agree or disagree with each other. But consensus appears to be a key element in deciding if the euro is too strong or too weak. A clear majority of member states need to be on board in opposing market movements before the market will pay any attention.

The ECB is primarily concerned with fighting inflation and seeks to achieve currency stability to foster long-term economic growth. Europe remains heavily export-orientated, so euro strength is the most likely risk factor for any forex market intervention from Europe.

Japan

The Ministry of Finance (MOF) is responsible for currency matters in Japan. The MOF is the most powerful government ministry in Japan and can wield more influence over Economic Affairs than even the Bank of Japan (BOJ), the central bank. The spokesman for the MOF is the vice minister for international affairs. Commonly the MOF issues daily comments on the forex markets when volatility increases.

The UK

The Chancellor of the Exchequer (Treasury Secretary or finance minister) is the individual responsible for the GBP. The Governor of the Bank of England also shares responsibility for GBP, since the Bank of England (BoE) became independent from the UK government in the late 1990s. This ensures an independent central bank.

The Chancellor and BoE generally steer clear of currency matters. The story behind that dates to 1992 when the GBP imploded and was forced to withdraw from the European Exchange Rate Mechanism (ERM), the predecessor arrangement which became the euro. Given this humiliating and bruising experience, it is unlikely any Chancellor will attempt again to manipulate the GBP.

The UK is closely aligned to the European economies, its largest trading partner, despite resisting joining the euro single currency. In 2020, the UK left the EU, which it had joined in 1973.

Switzerland

The Swiss National Bank (SNB) is in charge of the Swiss Franc (CHF) and setting Swiss monetary policy. The SNB focuses on the CHF’s rate versus the EUR, its largest trading partner. They will often speak when they think the EURCHF is too high or low in their view. The SNB’s main weapon is the interest rate, and it has used negative rates to make the CHF less attractive to the market. This has not been too successful as it is one of the sought after currencies. The JPY and CHF are the risk-off currencies of choice

Traders tremble at the memory of the SNB’s rugged manhandling in controlling the strength of their currency. In 2015, holding no bars when it comes to timing nor care for the wider industry, they removed the 1.20 floor of the EURCHF, even after saying that it was not something that they would do just out of the blue. It was the biggest and fastest currency move in most people’s lifetime, costing many folks and brokers a great deal of money. The clumsy move caused a shock that no speculator or central bank wants to see again.

The ‘Carry Trade’

A popular strategy used by institutions, banks and hedge funds is the carry trade. This is when you buy a high-yielding currency and sell a relatively low-yielding currency. This strategy profits in two ways:

-

By being long the high-yielding currency and short the low-yielding currency, you can earn the interest rate differential between the two currencies, known as the carry. If you have the opposite position, long low-yielder and short a high-yielder, the interest rate differential is against you, and this is known as the .

-

Spot prices appreciate in the direction of the interest rate differential. Currency pairs with significant interest rate differentials tend to move in favour of the higher-yielding currency as traders who go long on the high yield are rewarded, increasing further buying interest, and the short traders of the high-yielder are penalised, reducing selling interest.

This sounds like free money. More precisely a loan you get paid to take. Institutions use the carry trade to finance positions in stocks and other investments. They have very skilled and experienced traders managing their free capital source for them to do other things.

There is a catch, however. The catch is the downside spot price volatility can quickly swamp any gains from the carry trades’ interest rate differential. The risk can be compounded by excessive market participating and positioning favouring the carry trade, meaning a carry trade has become so popular that everyone gets in on it. When everyone who wants to buy has bought, why should the price continue to move higher? Remember the carry trade is made by institutions in enormous size. Even more daunting, if the price begins to reverse against the carry trade, it may trigger a panic exodus out of the trade accelerating the price plunge. This self-correction happens regularly and violently in the market to the cost of institutions who are financing their business using the carry trade.

US Economic Data

The US is the world's largest national economy, and the USD is on one side of nearly all currency trades.

Non-Farm Payroll

The non-farm payroll report is the US government's primary report for assessing the prior month's overall labour market. It is one of the most important data rate leases in the forex calendar and can often surprise. The number itself is broken down into parts.

Change in the non-farm payroll

This is the big number everyone focuses on. If you see a non-farm payroll estimate of plus 250,000, it means the consensus forecast is that the economy added 250,000 new jobs in the previous month. The non-farm payroll accounts for between 75 and 80% of US employment, excluding government, self-employed and farmworkers. When the economy is in a poor state, the number can be negative, indicating that more workers have become unemployed. The market’s initial reaction would largely be based on the difference between the actual and the forecast change in non-farm payroll workers.

Unemployment rate

The unemployment rate measures the number of unemployed individuals seeking work as a percentage of the whole civilian labour force. Increases in the unemployment rate are typically interpreted as a sign of weakness in the labour market and the economy overall. In contrast, declines in the rate are considered a positive indicator of the job situation and the economy.

Average hourly earnings and weekly hours

Average hourly earnings measure the change in employees’ wages and are looked at as an indicator of whether incomes are rising or falling and consumer spending implications. Average weekly hours measure the average number of hours worked each week and is looked at as a rough gauge of demand for labour. Increasing weekly hours are seen as positive for the labour market.

Inflation

Increases in inflation are likely to be met with higher interest rates by central bank policymakers seeking to stamp out inflation while a moderating or declining inflation reading suggests generally lower interest rate expectations. Inflation is the nemesis of bonds.

The market takes great notice of two pieces of data and will often respond sensitively to them:

- Consumer Price Index (CPI)

The CPI is what most people use as their measure of inflation. The CPI measures the cost of a representative shopping basket of goods and services at the consumer or retail level – the prices we're paying. Therefore, the CPI is the final stage of inflation.

- Personal Consumption Expenditure (PCE)

The PCE is similar to the CPI in it measures the changes in the price of a basket of goods and services at the consumer level. But the PCE is the preferred measure of the Federal Reserve as its main inflation gauge. The reason is, the composition of the goods and services in the PCE basket changes more frequently than in the CPI, reflecting evolving consumer tastes and behaviour. When the Federal Reserve refers to an inflation target or tolerable level of inflation, it is typically referring to the core PCE reading. The PCE is the Fed’s measure, although most people’s measure is the CPI.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP) measures the total amount of economic activity in an economy over a quarter, adjusted for inflation. The percentage change in GDP from one quarter to the next is looked at as the economy's primary growth rate measure. If the GDP in the first quarter of the year is reported as plus 0.25%, it means the economy expanded by 0.25% in the first quarter relative to its prior fourth quarter. GDP is frequently expressed in an annualised term. That means a 0.25% quarterly GDP increase would be reported as a 1% annualised rate of growth for the quarter. The use of annualised rates helps compare relative growth amongst economies. So, the GDP number you get is an annualised percentage derived from the quarterly value.

The GDP is reported quarterly for all developed economies, so it is taken as a big picture view of overall economic growth. Global institutions such as the have a go at calculating GDP values for developed economies. GDP will not influence any individual currency but does indicate the economic health of the world.

The market’s economic outlook will be heavily influenced by what the GDP report tells us. Better than expected growth may spur talk of the need for higher interest rates, while steady or slower GDP growth may suggest easier monetary policy ahead. But GDP reports cover a relatively distant economic past. A quarter's GDP report is typically coming out almost midway through the next quarter and is looking back at economic activity three or four months ago. As a result, market expectation continues to evolve based on incoming data reports. So, when you receive one of these important big data releases, it tends to have a short life of market impact. The new GDP number was looking back, and now we have new information which will form part of the next GDP release. It is an important number, it often causes violent moves, but the market effect is usually short-lived.

Trade and Current Account Balances

Trade and current account balances are important reports for forex markets and have direct and potentially long-term currency implications.

Trade Balance

Trade Balance measures the difference between the nation’s exports and imports. If a nation imports more than it exports, there is said to be a trade deficit. If a nation exports more than that imports, it said to have a trade surplus. Trade balances are reported monthly, and prior periods are subject to revision. Trade balances are currently considered important, particularly to the US, which wishes to see unjust balances rectified and aggressively force changes in relationships with its trading partners. We saw this at an extreme under President Trump.

Current Account Balance

Current account balances is a broader measure of international trade. It includes financial transfers as well as trade in goods and services. Current accounts are also either in deficit or surplus, reflecting whether a country is a net borrower or lender to the rest of the world. Nations with current account deficits are net borrowers from the rest of the world, and those with current account surpluses are net lenders to the world. Current account reports are issued quarterly. Because the monthly trade balance comprises the bulk of the current account balance, markets tend to have a good idea what to expect in the current account data. Economists’ forecasts tend to be generally correct.

Retail Sales

Retail Sales data is the primary indicator of personal spending in the US, covering almost every purchase from petrol station spending, dining out, and shopping trips. Retail sales are reported on a headline basis as well as the core basis. The core basis excludes automobile purchases. The market first focuses on the core headline to handle how the consumer is behaving. Substantial strength or weakness in the auto industry is also important as it plays a major role in the manufacturing sector.

The Retail Sales report is a preliminary estimate based on a survey of samples and can be revised (sometimes) substantially based on later data. Retail Sales reports are subject to a variety of distorting effects, most commonly from the weather. Stretches of bad weather, such as major storms or bouts of unseasonable cold or heat, can impair consumers mobility or alter shopping patterns, reducing retail sales in the period. During the 2020 COVID-19 pandemic, the market looked at the Retail Sales data to indicate how keen people were to return to ‘normal’.

Sharp swings in petrol prices can also create illusionary effects, such as the price spikes leading to an apparent increase in retail sales due to higher petrol prices, while overall retail sales are reduced or displaced by the higher outlays at the pump.

The Housing Market

The US and other major economies' housing markets have taken on increasing importance in recent years, as real estate valuations increased dramatically, ultimately producing the dreaded real estate bubble. As a result, housing sectors have become an important factor in gauging the overall economic outlook.

Existing home sales

Existing Home Sales is reported by the National Association of Realtors. Sales of pre-existing homes account for about 80% of total home sales. Existing home sales are reported monthly as an annualised rate. Median home prices and inventory of unsold homes are important clues to how the housing market is evolving. Existing home sales are counted after it is completed. Pending home sales are a separate report viewed as a leading indicator of existing home sales. Pending home sales are counted when the contract is signed to buy but not yet completed.

The Federal Reserve’s Beige Book

The Beige Book (it has a beige cover) is a compilation of regional economic assessments from the Fed’s 12 district banks. It is published about two weeks before every Federal Open Market Committee (FOMC) policy-setting meeting. The FOMC meetings are closely watched for clues as to the thinking and intentions of the central bank. The Beige Book is designed to serve as a basis of economic discussions at the FOMC meeting. So the market can see the data the FOMC is working with and what they will discuss and worry about.

The main themes of the report are:

-

Is the economy expanding or contracting? How fast, and how widespread?

-

Which sectors are the strongest, and which sectors are the weakest?

-

Are there any signs of inflation?

-

How does the labour market look?

Note: The Beige Book is released in the afternoon New York time when liquidity is thin and can generate a larger than normal response if its tone or conclusions are significantly different from what the markets were expecting. Watch out!

International Data Reports

We have covered the main economic reports using US data to explain what each report measures and how the market views them. Other major national economies' main data reports essentially mirror the US data reports, but with some minor differences in calculation methods or reporting. In other words, the CPI report from the UK is looked at the same way as the CPI report is viewed in the US — as a measure of consumer-level inflation. You can apply the descriptions of the main data reports we have covered to the counterparts from other countries, keeping in mind that the foreign data reports' names differ slightly. But plenty of national data reports do not have an equivalent in the US, and others are followed more closely in local markets and require extra attention.

Eurozone

The main data reports from the eurozone are remarkably similar to those of the US. The key differences are the individual European countries report national economic data. This comes out alongside eurozone-wide reports from the European Commission or European Central Bank.

Because the eurozone has a common currency and central bank, the forex market focuses primarily on eurozone indicators covering the entire region, such as eurozone industrial production and trade balance. Among individual national reports, the market concentrates on key reports from the largest eurozone economies: Germany and France. Keep a close eye on all the major data reports coming from these countries. They can generate sizeable reactions based on the idea that they are leading indicators of eurozone-wide data or that they represent development affecting the region as a whole. If German industrial production slumps, for example, this may suggest the overall eurozone industrial production is set to decline, too. When the euro itself is under stress, and the pressure is coming from the conflict between the northern and southern eurozone countries, we need to look at individual country actions. At those times, the behaviour of individual countries within the bloc becomes more important and watched. At times like this, some political or economic activity in Italy, for example, can affect the euro as a whole.

There is a set of data in the eurozone that can sometimes take on importance. They are reports from industrial organisations which represent the confidence of business and industry. These reports go by the acronyms of the groups that put them together. They can generate sizeable reactions when they are out of line with expectations. The three main ones to note are ZEW, GfK and IFO surveys.

Japan

Japan’s economy is heavily export-orientated. In addition to the usual reports, please pay attention to industrial production and manufacturing data because of their sizeable role in the Japanese economy. There are two reports which are important to watch:

Tankan Index

The big corporate sentiment survey in Japan is called the Tankan Index. The Bank of Japan (BoJ) issues the Tankan Index at the beginning of each quarter after surveying some 10,000+ Japanese firms on their outlook. The Tankan report is expressed as a , where negative responses are subtracted from positive responses, resulting in a net reading. The higher the Tankan Index, the more optimistic the outlook for the economy.

Trade Balance

Japan's monthly trade balance is nearly always a surplus. The size of that surplus indicates the export sector's health and potential political repercussions against excessive JPY weakness when the trade surplus has seemed to be too large. The US, in particular, takes exception to its trade imbalance with Japan.

UK

In addition to the usual data reports, be alert for the following reports that can frequently trigger big moves in the GBP:

Bank of England Minutes

These are released two weeks after each Monetary Policy Committee (MPC) meeting. They show the voting results for the most recent decision on interest rates. Market expectations and GBP are frequently upset when the policy vote shows dissent rather than unanimity.

Canada

Canadian data mirrors US data in most respects. Canada is a commodities nation; its economy is highly sensitive to the price of raw commodities. Watch grain and metal prices. Slumps can significantly affect the CAD.

There is one important Canadian indicator to watch.

International securities transactions

This is roughly the equivalent of the US treasury's TIC (Treasury International Capital) report, showing the net investment flows into and out of Canada monthly. High inflows typically support the CAD, and outflows tend to hurt it.

Australia

Australia is also a commodities country. The AUD is highly sensitive to global commodity prices, which are affected by supply and demand stemming from the state of the global economy and inflation. Commodities are traded in USD. When a country buys grains from Australia, they will agree on a price in USD requiring hedging for both parties.

Switzerland

There are relatively few important economic data reports from Switzerland, and they usually fit the standard set of economic data. Swiss data tends to have the greatest impact on the EURCHF, especially if the two economies seem to be diverging in economic growth or interest rates.

New Zealand

New Zealand's fortunes are surprisingly important as it features in many carry trades due to its relatively high level of benchmark interest rates. It issues the usual set of main economic data reports. Forex analysts and traders closely watch this small economy's economic state because of the enormous size of the carry trade used to fund hedge funds. For many years, the NZD has been the preferred high yielding side of the carry trade due to it's stable and healthy economy considered to be low-risk buy carry traders. It is vital that the long side of the trade, high yielding currency, does not depreciate as this takes away the advantage of the yield. The NZD can be very volatile when the carry trade becomes too large and one-sided and corrects or when New Zealand has an episode of bad luck, so be vigilant.

Trade Balance

New Zealand's trade balance is critical due to the relatively small size of the economy and the importance of trade and exports.